Has Australia lost all perspective on what represents housing affordability?

My short answer to that question is yes, recent median coverage suggests to me that so much of the commentary around housing is completely negligent of what most people earn.

In recent weeks I’ve been seeing quite a few stories which reference what is considered affordable housing or relatively affordable housing and I am quite gobsmacked as to what is considered affordable.

The first story was one from REA Group the particular reference to me that was startling was the reference to Margaret River having a “relatively affordable” median house price of $825,000.

The second story was from The Guardian which talks about a two bedroom apartment in Bondi Junction which is part of an “affordable” housing scheme which has been listed at $1,100 per week to rent.

Unfortunately household income data isn’t published regularly in Australia. The 2021 Census is getting quite old by this point but at the time of the Census, the national median household income was $1,770 per week which translates into a median annual household income of $92,040.

We’re now in 2025 so the national median household income is likely to be higher but not substantially so. As a rough estimate let’s say the median household income in Australia is now $100,000. Meaning roughly just as many households earn more than $100,000 as those that earn less than $100,000.

We’ve just seen that over the Mar 24 quarter that for the first time ever the average home price in Australia has eclipsed $1 million.

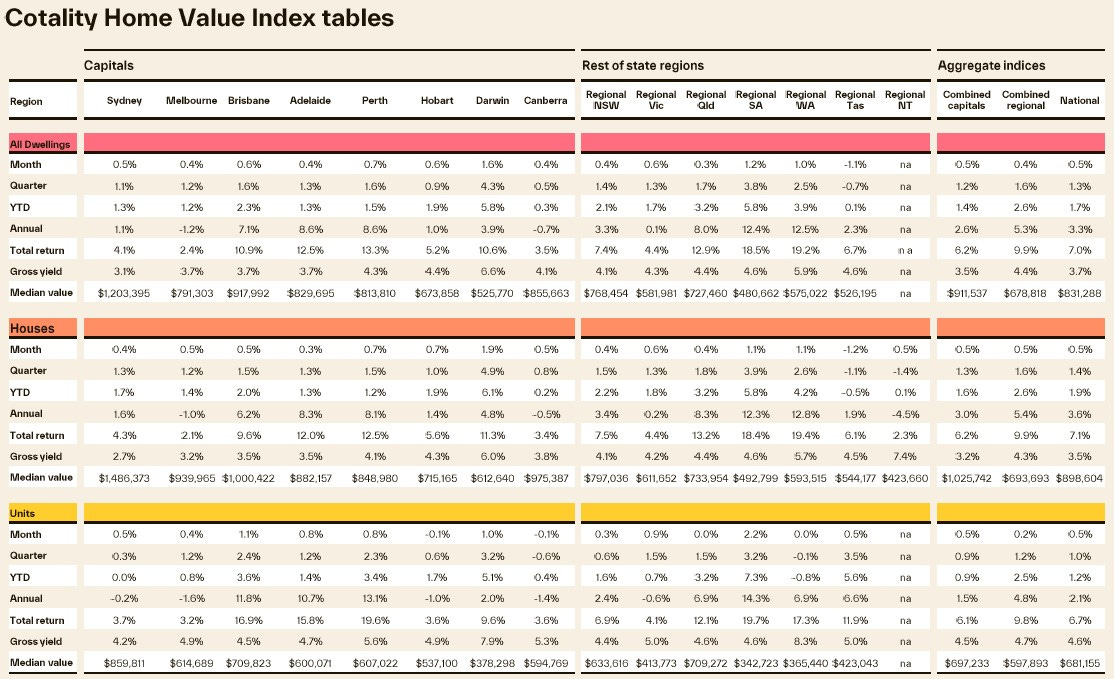

If we look at the latest data from Cotality for May 25, they estimate the median value of all residential properties in the country is $831,288 and the figure is higher across the combined capital cities ($911,537) than it is in the combined regional markets ($678,818).

Based on Cotality’s median value, the typical property value is 8.3 times higher than the median household income. If we look at the above table, the median dwelling value in each capital city is more than 5 times annual household incomes in all capital cities and more than 8 times annual household incomes in most of them (more than 12 times in Sydney).

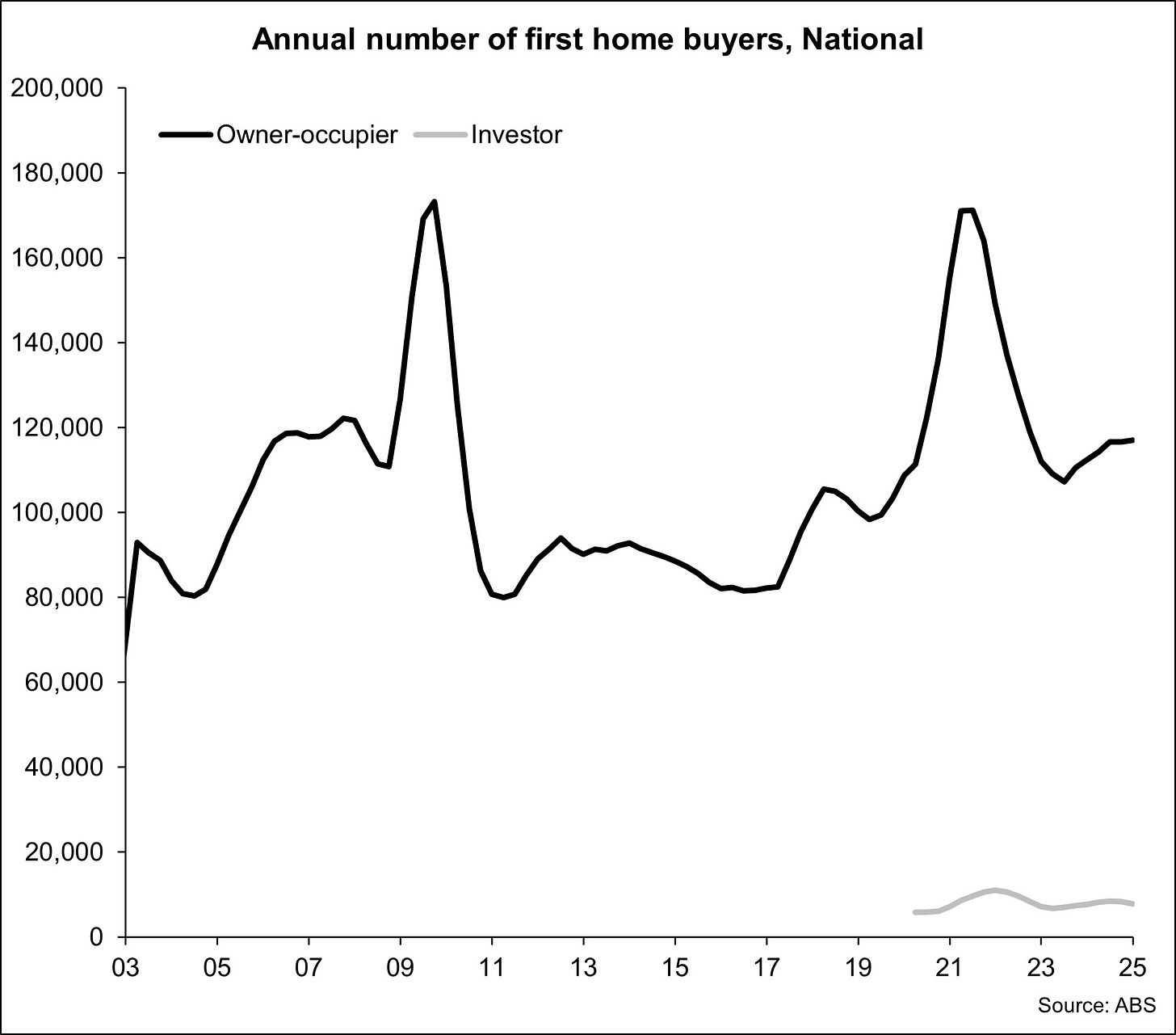

It’s important to remember that a relatively small cohort of people are entering the market for the first time right now. Over the 12 months to Mar 24 there were 116,968 owner-occupier first home buyers nationally which was the highest volume since Dec 22. Over the same period there were 7,786 investor first home buyers which was -6% over the quarter but +0.8% over the year.

The current value of housing largely affects those people that have no equity and are entering it for the first time. Keep in mind that most first home buyers will not be purchasing the median property they will be buying something cheaper but equally, there is likely a significant cohort of first home buyers earning less than the median household income.

For those people aspiring to enter the market I say good luck if you are earning less than the median household income and are looking for a well located property, unless you have some other source of support. Even in that situation, if you are a first home buyer chasing a desirable, well-located property you will often times be competing with investors or upgrading owner-occupiers that already have equity in the market. These purchasers also purchased their properties at lower prices than what is available now and have ridden the wave of home value growth which has been quite persistent over recent years and decades.

Given all of this and our rough estimate of median household income I think it is very clear that we’ve lost perspective on housing affordability, especially for first home buyers and for renters.

The first scenario detailed in this piece looked at houses in Margaret River which were described as “relatively affordable” at 8.25 times the median household income nationally.

Looking at the second scenario detailed above for the affordable rental apartment in Bondi Junction, someone looking to rent this property on a median income would be spending $57,200 a year on renting that property. This is more than half the median household income and affordable housing programs are supposed to be providing lower priced rentals to low and middle income households.

What do you think, do we actually have a decent perspective on what is affordable when it comes to home prices and rents or have we lost perspective?

Bondi apartment likely best for 2 renters/incomes.

What are the monthly payments assuming 30y mortgage? And how do they compare?

I bought many years ago, and it was initially tough way back then. Took until I reached 30+ before I could afford to buy with my partner.

Tough for first home buyers is nothing new. We need to acknowledge that.

Paying down principle and growing income gives optimism. It gets easier.

Not being able to find an affordable property that is well located is a planning issue.

And once a first home buyer gets their first home, they join the rest of society that wants house prices to go up.

These are just observations. Affordable housing is necessary and society benefits from it immensely. I wonder though, how much of the issue is due to changing demographics.